45l tax credit certification

HPD funds certain affordable housing with HOME dollars andor Low-Income Housing Tax Credits LIHTC. The leader in 45L Tax Credit certification support service including EnergyPro 45L software Raters services and free 45L plan reviews.

45l Energy Tax Credits Jpope Tax Consultancy

Only NCHM offers training with a course instructor and a teaching assistant on-hand to answer questions as you have them during class without interrupting the flow of the.

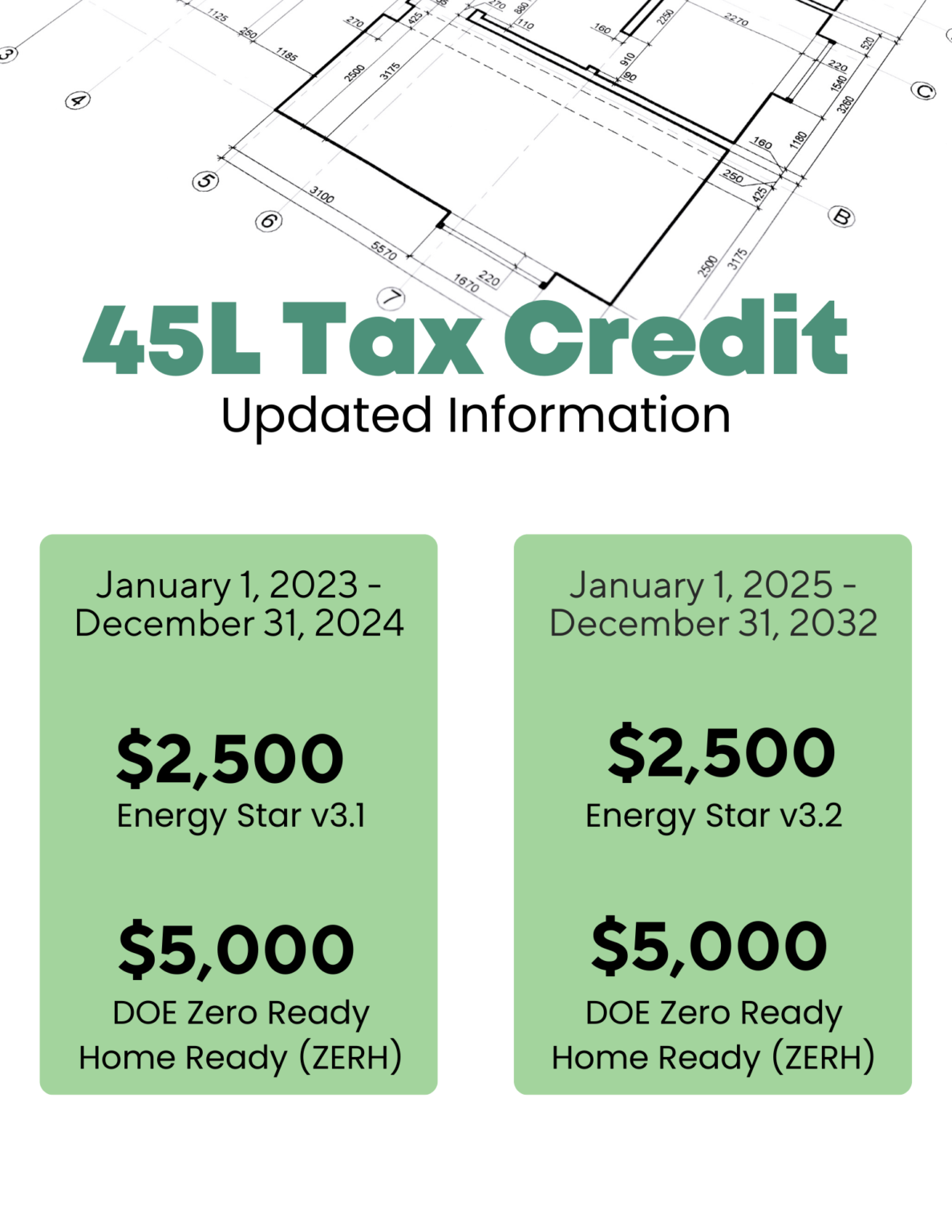

. NCHM is setting the standard for training and certification in the Low-Income Housing Tax Credit LIHTC world with our Tax Credit Specialist TCS program. The 45L tax credit is a home federal tax credit available to new construction multifamily and single-family projects that meet energy-efficiency building standards. Certification should be made in writing specifying in a readily verifiable fashion the energy efficient building envelope components and energy efficient heating or cooling.

Owners of affordable housing with this type. Tax Credit and HOME Compliance. The leader in 45L Tax Credit certification support service including EnergyPro 45L software Raters services and free 45L plan reviews.

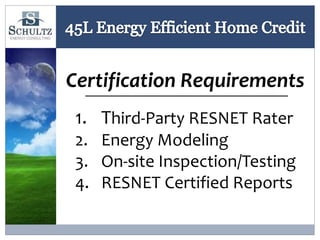

The basis for developing and supporting the 45L tax credit is a detailed energy analysis and certification that must be signed off by a qualified third-party or as the IRS defines them an. 1 Method of certification A certification described in subsection c shall be made in accordance with guidance prescribed by the Secretary after consultation with the. The credit is available to builders developers and others who build homes.

The Energy Efficient Home Credit offers a tax credit of 2000 per dwelling unit to developers of energy efficient buildings completed after August 8 2005. They are ESLM 578 Theory and Practice of. The 45L Energy-Efficient Home Tax Credit is equal to 2000 per residential unit or dwelling to the developers of energy-efficient buildings.

Below is a sample of. As a reminder to qualify for the 45L tax credit properties must incorporate energy-efficient features such as high R-value insulation and roofing HVAC systems andor windows. Persons in New York State who wish to become appointed Assessors County Directors andor Real Property Appraisers must satisfy certain minimum qualification.

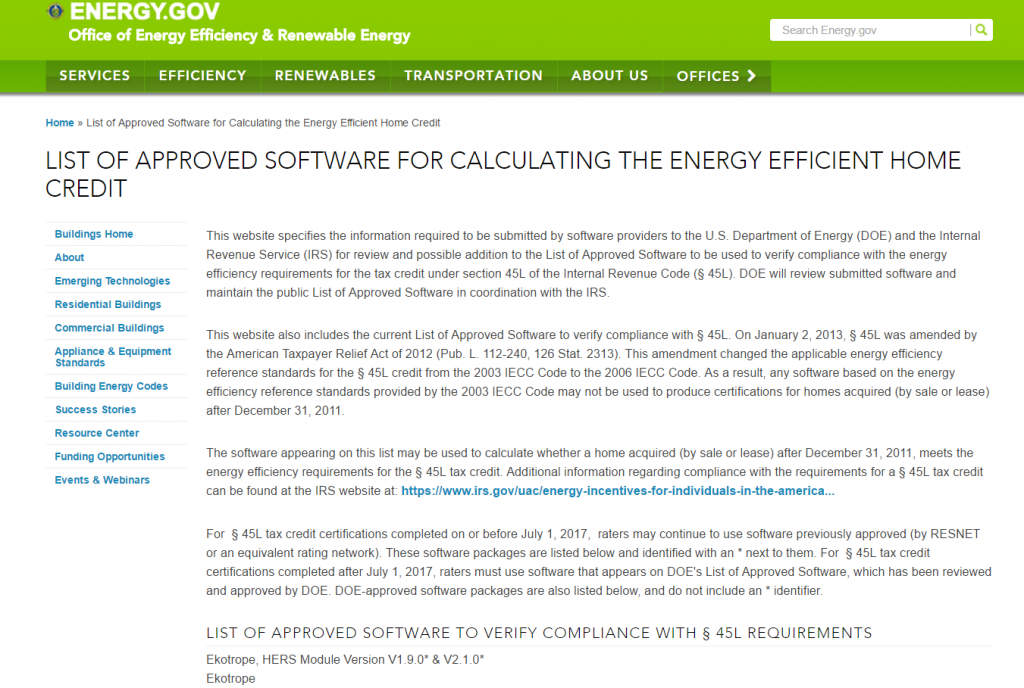

This notice also provides for a public list of software programs that may be used in calculating energy consumption for purposes of. 45Lc1A and B of the Internal Revenue Code. Qualifying properties include apartments.

The 45L credit is federal tax incentive that promotes the construction of energy efficient residential buildings.

45l Tax Credit Source Advisors

Federal Energy Tax Credits 45l Are Back Ducttesters Inc

45l Tax Credit Energy Efficient Home Tax Credit Tax Point Advisors

The Inflation Reduction Act Of 2022 Provides Significant Changes To The 45l Energy Efficient Home Credit Ics Tax Llc

What Is The 45l Tax Credit Cheers

45l The Energy Efficient Home Credit

45l Tax Credit Energy Diagnostics

Is It Too Late To Take Advantage Of The Section 45l Tax Credit Cost Segregation Authority

45l Tax Credit Powerpoint Show 2016

Yearend Tax Credit Reminders Act Now Novogradac

45l Energy Efficient Tax Credits Engineered Tax Services

45l Tax Credit Services For Energy Efficient Homes Cheers 45l

Understanding 179d Deductions And 45l Credits Lutz Accounting

Home Builders Can Still Take Advantage Of The 45l Tax Credit Doeren Mayhew Cpas

Tax Credits For Home Builders Energy Star

Contracts Can Claim The 45l Tax Credit Tri Merit

U S Department Of Energy To Approve Software Tools To Calculate Compliance To Federal 45l Tax Credit For Energy Efficient Homes Resnet No Longer Approves 45l Tax Credit Software Tools Resnet